Business

Global Pharma Companies Escalate U.S. Investments Amid Potential Trump-Era Tariffs

Hilario Ongpauco

10 Feb, 2026

As the Trump administration considers imposing a 100% tariff on imported branded and patented pharmaceuticals, leading global drugmakers are rapidly enhancing their U.S. manufacturing capacity and stockpiling inventory to circumvent potential penalties.

Although enforcement of the tariffs is deferred for companies making U.S. investments, the policy has already spurred accelerated project timelines, price reductions, and a shift toward direct consumer sales.

Pfizer, for example, secured a multi-year exemption by agreeing to invest $70 billion in domestic research, development, and manufacturing, obtaining a three-year reprieve from the tariffs following a deal with President Trump. Similarly, AstraZeneca committed to a $50 billion investment focused on U.S. manufacturing through 2030, including a major new facility in Virginia and expansions in several other states.

Other pharmaceutical giants have announced substantial plans to expand their footprint in the United States:

- Eli Lilly has pledged $5 billion for a manufacturing plant in Virginia, the first of four planned plants under a $27 billion expansion strategy.

- Johnson & Johnson expects to increase U.S. investments by 25%, reaching $55 billion over four years, with new plants in North Carolina and elsewhere.

- Roche intends to invest $50 billion over five years, recently expanding its diagnostics facility in Indianapolis with an additional $550 million investment projected to create over 12,000 jobs across multiple states.

- Novartis plans a $23 billion spend to build and expand 10 facilities, including six new manufacturing plants.

- Sanofi is targeting a $20 billion investment through 2030, combining internal expansions and partnerships to enhance manufacturing capabilities.

- Merck has initiated construction on a $3 billion pharmaceutical plant in Virginia, supplementing over $70 billion earmarked for U.S. manufacturing and R&D, with additional investments in Delaware and North Carolina.

Biogen, Amgen, AbbVie, Gilead Sciences, Cipla, CSL, and others have also outlined significant investments spanning research, development, and manufacturing to strengthen their U.S. presence, underscoring a trend toward onshore production amid tariff uncertainties.

Industry leaders emphasize that increased local manufacturing and strategic inventory management are crucial to minimizing potential tariff impacts. Roche CEO Thomas Schinecker highlighted the company’s proactive approach by shifting inventory and scaling up U.S. production ahead of tariff enforcement.

Moreover, several companies, including Pfizer and AstraZeneca, reported that any tariff-related disruptions are expected to be brief due to early preparation and ongoing investments.

These moves not only aim to protect companies from tariff-induced cost increases but also align with broader strategic goals of securing supply chains and enhancing domestic pharmaceutical production capacity in the United States.

Recommended For You

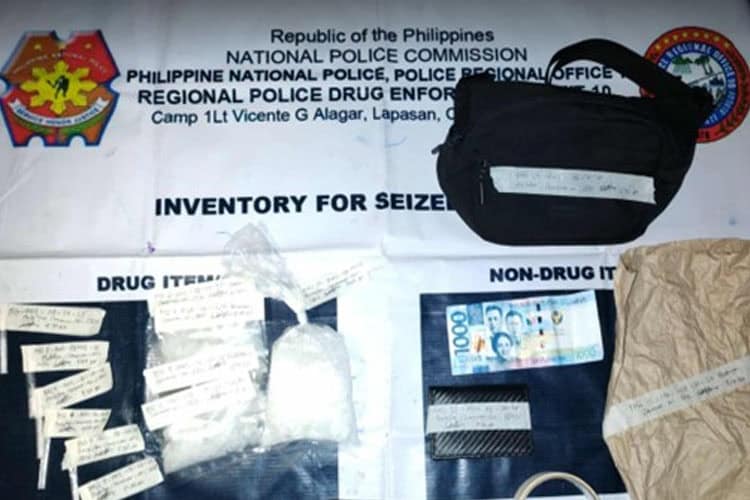

Authorities Arrest Two Drug Suspects, Seize P421,600 Worth of Illegal Drugs in Lanao del Sur

Feb 10, 2026

Hilario Ongpauco

Cassiopea Sacrifices Herself to Defeat Zaur in "Encantadia Chronicles: Sang’gre"

Feb 10, 2026

Soledad Evangelista

Global Pharma Companies Escalate U.S. Investments Amid Potential Trump-Era Tariffs

Feb 10, 2026

Hilario Ongpauco

Home Depot Lowers Full-Year Outlook Amid Soft Home Improvement Demand

Feb 10, 2026

Gaudencio Roxas